Entering Salaried Employee Information

Enter a new employee record within Payroll

> Employees if the employee record has not been created. Select

Edit > New from the employee

list or click New within the employee

window to create a new employee record the same way other employee records

are created. Review the Workers >

Entering New Workers section for detailed instructions on how to create

a new employee record.

Complete the following steps to setup the desired salaried employee

pay information:

Go to

and the following window will appear:

Select the Salary pay

type.

Enter the employee’s salary wage within the Salary

field. The salary amount should reflect the salary for each pay period

as set in the Pay Frequency

field. If the Pay Frequency is set to Weekly the salary amount should

equal the employee’s weekly salary wage.

If the employee is paid overtime pay over and above the annual

salary then enter the base hourly rate within the Hourly

Pay field. Do not enter the overtime rate (time and a half)

but enter the base rate. This field can be ignored or blanked if the

salaried employee is never paid any additional hourly pay such as

overtime or benefit time.

The Previous Pay settings

are optional values that can be used to record pay raises in the future.

Pay Frequency should

be set to the length of the normal payroll period such as Weekly or

Bi-Weekly.

Verify that the pay Method

matches the payment method for this employee. Review the following

documentation for more details on this important setting:

Check: Getting

Started > Configuring Payroll Forms

Direct Deposit:

Direct Deposit > Worker

Configuration

Payroll Service:

3rd Party Pay

The Is subject to minimum wage

option should be enabled under normal circumstances. This option is

important if piecework payroll is being utilized.

Remove the Regular pay

type as well as any other pay types that should never be used for

a salaried employee.

Insert a new salary pay type for this employee by clicking on

the New Rate button. If no

salary pay type is available take the following steps:

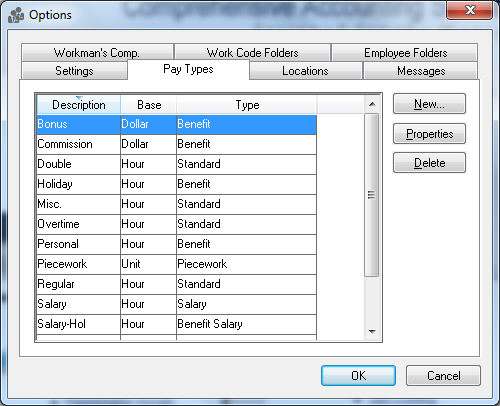

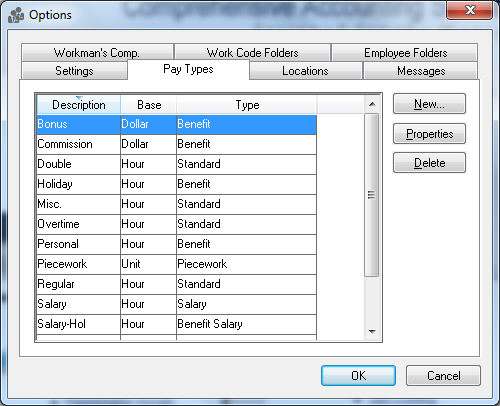

Go to Labor > Options

> Pay Types window.

Click on the New

button.

Enter a Description

for the salary type such as Salary

Set the Base as

Hour

Set Type as Salary.

Click OK to create

new pay type.

Review the Getting Started > Pay Types

section for more details in creating Pay

Types.

Benefit Pay

Benefit pay can be calculated one of two (2) ways for salaried employees:

If

the benefit pay is over and above the Salary

pay amount, the benefit pay type should be setup using the standard

holiday and/or vacation pay types explained within the Workers

> Benefit Pay section of this manual.

If

the benefit pay is included in the employee’s total salary but the

number of hours (days) of benefit hours received must be recorded

through the payroll system. Proceed with the following procedure:

NOTE: Continue

with this section only if the total salary pay includes benefit pay.

Go to to list all available pay types.

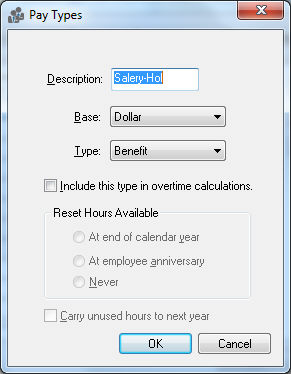

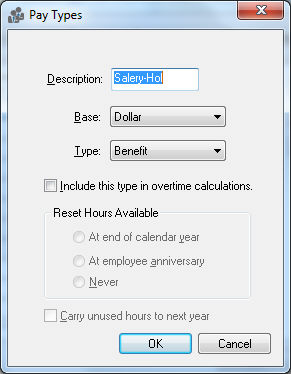

Click on the New

button to create an additional pay type:

Enter a benefit salary pay Description such as Salary-Hol

for holiday pay for salaried employees since pay type - HOLIDAY is

used for additional holiday pay.

Enter a Base

type as Hour.

Select Benefit

Salary for the Type field.

Note that the Type option list includes a Benefit type and a Benefit

Salary type. To enter benefit pay types

for a salaried employee without changing his/her salary pay, use the

Benefit Salary type rather than the Benefit type. Go to the Workers >

Benefit Pay section for details in creating benefit pay such as

holiday pay and vacation pay for hourly employees.

The benefit salary pay types must

be added to the salaried employee’s pay rate list before they can

be used within a timecard. Review the Workers

> Benefit Pay section for details on adding benefit pay to

an employee.

NOTE: When these benefit salary pay

types are used within the timecard, the pay is calculated for the benefit

detail lines the same way as the standard salary pay.