Processing Vendor Credits and Refunds

Vendor credits should be entered in the same manner as a vendor invoice,

but the total will be a negative value. Go to Expenses

> Invoices and P.O.s to enter a

credit memo.

Enter the vendor information the same way as a vendor invoice and enter

the credit memo number in the Invoice

field. The Payment method should

be set to Charge to process the

refund later or to apply the credit toward a vendor invoice. The Payment type can be set to the Urgent option if the user wishes

to apply the credit immediately. The credit memo will be selected to be

paid in the vendor payments window and a check will be generated as soon

as the total of the selected vendor invoices exceeds the credit amount.

Enter negative Ordered and Received quantities if the credit

memo lists inventory items that have been returned to the vendor. The

negative Received value will increase

the count of the inventory Item

that is classified as Track Count.

Process the credit memo using the same steps as processing a vendor

invoice. For more information on entering or processing vendor invoices,

review the Invoices section.

Go to Expenses >

Vendor Payments to apply a credit toward an existing invoice

or to process a vendor refund:

Select the invoices as well as the credit memo. If

you wish to apply the credit toward existing invoices, change the

payment amount of the invoice to match the amount of the credit. A

check will not be generated and the invoices and credits will not

be processed if the total amount for the vendor is less than zero.

Complete the following steps to process a cash refund that has been

received from the vendor.

Enter a credit memo by entering a credit vendor invoice

if it has not already been entered and processed. Make sure that the

Payment type is set to Charge when processing the credit

invoice.

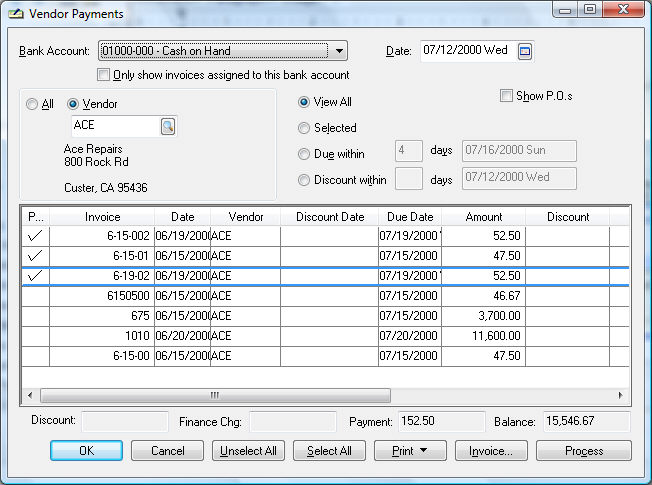

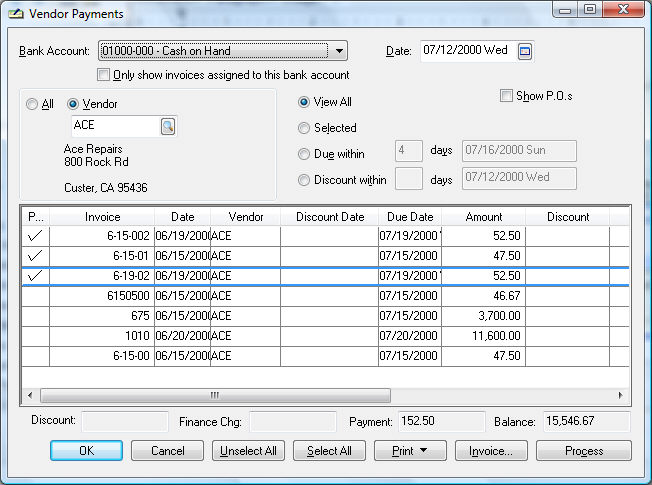

Set the Bank Account

within the vendor payments window to a general ledger cash account.

This will apply the refund to the cash account in a similar way as

a payment that has been received from a customer.

Enter the date that the refund was received in the

Date field.

Set the All, Vendor

option to Vendor. Note:

When the Process button

is clicked and the option is set to All,

the system will ignore any outstanding vendor total that is less than

zero.

Enter the vendor's ID code. All the outstanding invoices

and credit memos will be listed on the window including the credit

that the vendor has refunded. Be certain that the credit was processed

properly if the refunded credit does not appear.

All outstanding invoices and credits that are not

affected by the refund should be switched OFF. The Payment

total should equal the negative amount of the refund.

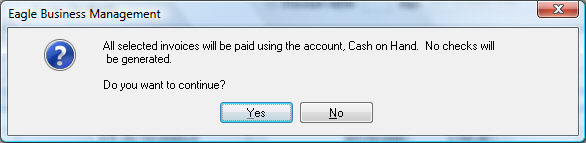

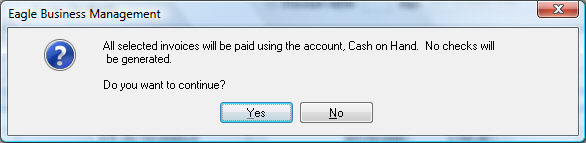

Click the Process

button and the following message will appear:

Click the Yes

button and the credit memo will be processed and removed from

the outstanding list. The refund will appear in the deposit screen

(Sales > Deposits) in the

same manner as a customer payment.

See the other sections within the Expenses

> Vendor Payments section for more details.