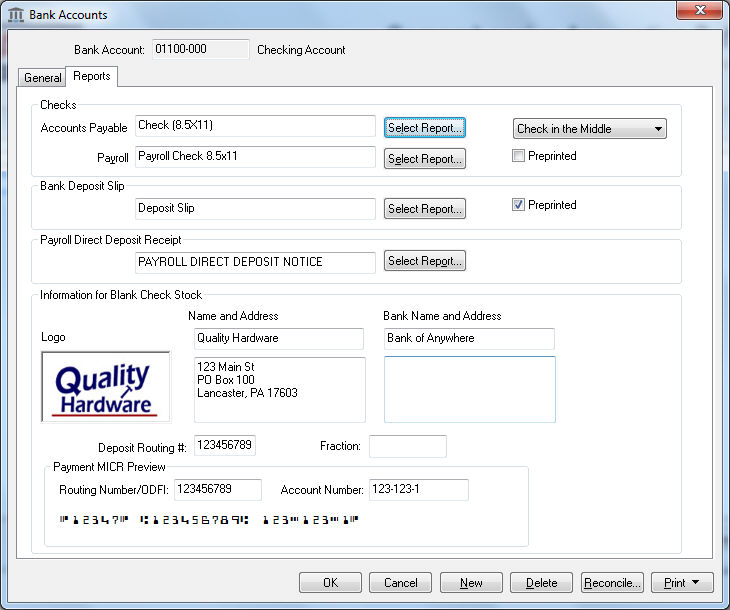

Open a bank account configuration record by selecting Expenses > Bank Accounts from the main EBMS menu.

Click on the Reports

tab as shown below:

Select the appropriate Accounts Payable check form created with Crystal Reports as shown above.

Repeat the same step to select a plain paper form for the Payroll Check.

Set the proper check location setting of either Check on Top or Check in the Middle. This setting must match the format of the check stock. See the reverse side of the security paper to determine the proper setting if the checks are not preprinted.

Disable the Preprinted form option to print logo, lines, check number, and bank information on the plain security paper.

Select the appropriate Bank Deposit Slip as shown above. The bank deposit slip can be printed on plain perforated paper. This perforated white paper can be purchased from Eagle Business Software.

Enable the Preprinted form option to print on preprinted deposit slips or Disable this option to print on plain paper.

Select the desired Payroll Direct Deposit Receipt from option. This receipt form is always printed on plain paper stock.

Set the following Information for Plain Paper Forms. These settings can be kept blank if all forms are preprinted.

Right click on the Logo field and select Insert Image. Select the logo image file to be used on blank security checks or the bank deposit slip.

NOTE: File requirements are identical to those of the Company logo as specified in File > Company Information.Enter the company name and company address in the Name and Address fields exactly as it is to be printed on the Plain Paper Check.

Enter the name and address of the financial institute in the Bank Name and Address fields exactly as it is to be displayed on the Plain Paper Check. The Bank Name is also used on the Direct Deposit ACH file.

The Deposit Routing # should be the same as the Payment Routing Number unless your bank uses a different routing number for deposit transactions.

The Fraction number is a series of numbers printed on Plain Paper checks. It is determined by your financial institution. It is generally printed below the Bank address.

The Payment Routing Number is the routing number printed on checks and is used on the plain Direct Deposit ACH file.

The Account Number is the bank account number printed on plain security check paper, deposit slip, or direct deposit file and receipt.

The bank account and routing number should appear at the bottom of the dialog using the proper MICRO font. This specialty font must be installed on the computer if this fond does not appear properly.

Save the information for the selected bank account by clicking the OK button. Repeat these steps for each bank checking account that will be printed on plain security paper.