EBMS gives the user the ability to group revenue and expense accounting into multiple funds. Fund accounting is used within many non-profit organizations to track multiple expense/revenue funds. For example, an organization may set up multiple funds such as a general fund, fund for a specific function, or special fund. These funds allow those who manage the finances to match donations (revenue) with specific expense groups such as a scholarship or a specific mission or event.

Most corporations and other businesses do not use fund accounts. You may wish to ignore the following Fund Accounting sections unless your organization is interested in fund accounting.

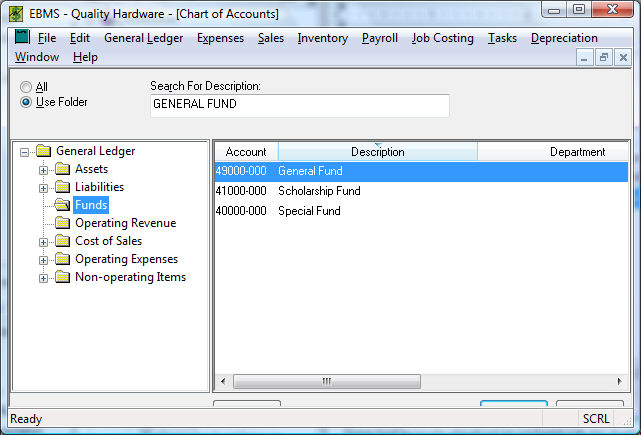

The first step in creating a fund is to create a new fund account with

a type of Capital. This account

records the fund balance within the general ledger. A non-profit organization

often renames the Equity or Capital group of general ledger accounts as

Funds as shown below:

These fund accounts should not be confused with the revenue or expense

accounts that will record the donations or expenses for a specific account.

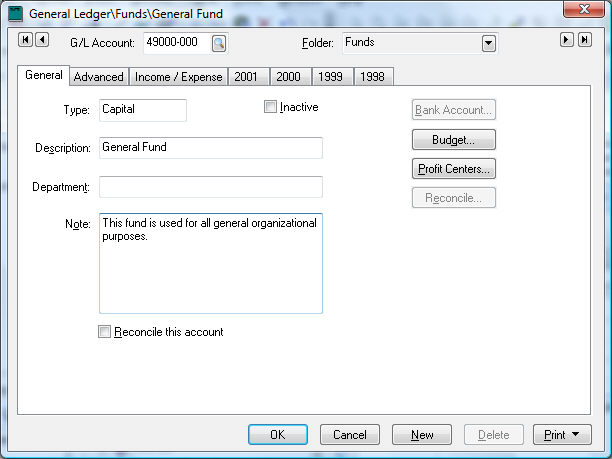

These accounts will be described later in this section. Create an account

for the fund balance with a Type

of Capital as shown below. Review

the Adding General Ledger

Accounts section for more details on adding new general ledger accounts.

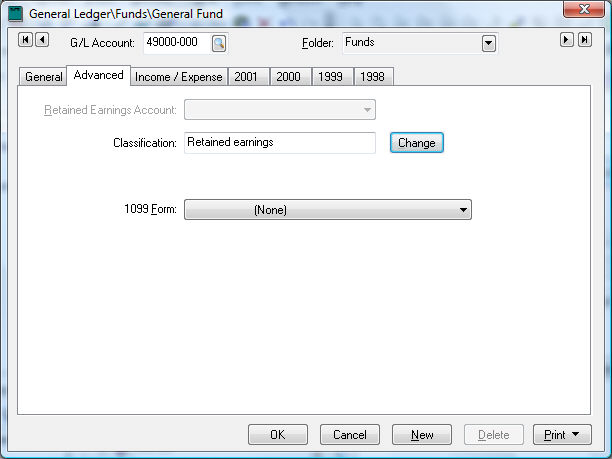

A fund account must be classified as Retained

Earnings as shown below. The Retained

Earnings label is a corporate term (rather than the correct term

of fund) that functions within EBMS as a fund. An account must be created

for each fund and all accounts must be classified as Retained

Earnings. The normal corporate chart of accounts contains only

a single retained earnings account. There are multiple accounts classified

as Retained Earnings within a

fund accounting system.

Click on the Income / Expense

tab of the fund account.

This tab will only show on accounts that are classified as Retained Earnings. This list will be empty if the fund account is new. Complete the following steps to attach revenue and expense accounts to the fund account:

The revenue and expense transactions do not post directly to the fund account classified as Retained Earnings. The total current earnings (Revenue Expenses) for a specific year are posted to the fund account. The year end balances for all assets, liabilities and capital accounts are carried forward to the next year but all year-end totals for revenue and expenses accounts are posted to the specified fund account. For example, if the total contributions for last year was $1,000,000 and the expenses totaled to $800,000, a total of $200,000 would be added to the beginning balance of the fund (retained earnings) account.