Changing Account Information

Go to and a Chart of Accounts list will open.

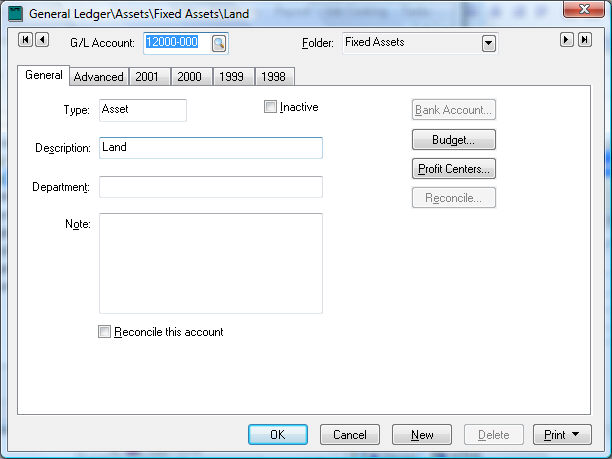

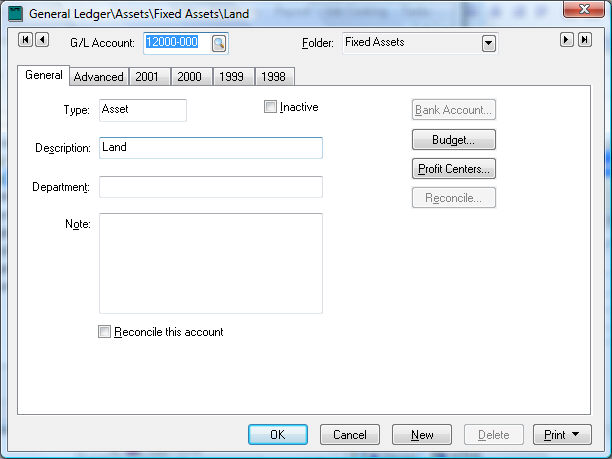

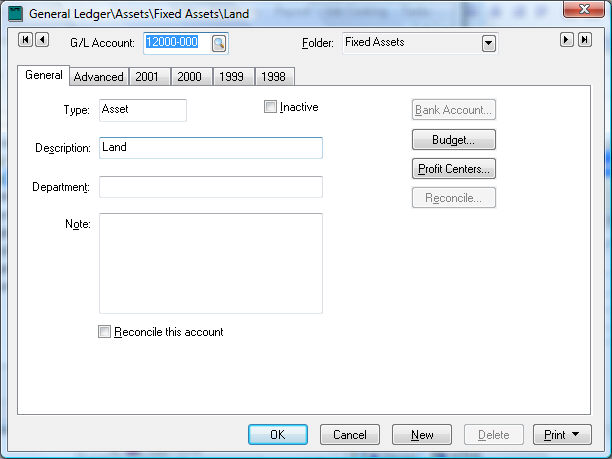

Open the account you wish to view or edit as shown below:

On the upper part of the window the following information will appear:

- The title part of the window displays the folder and subfolders in which this account appears followed

by the account description.

- The G/L Account code is

the code used throughout the system to identify this account. Review

the Adding General Ledger

Accounts section for more details about creating this code. Review

the Changing

or Moving an Account to Another Folder section for instructions

on how to change the G/L Account entry.

Select a new account by using the lookup button located to the right

of the G/L Account entry.

Use the Page Up and Page Down buttons to position to the first account,

previous account, next account, or last account.

To change the Folder in which

this account resides, click on the down arrow and select new folder. Note

that the account code needs to be within the range allowed in the selected

folder. Review the Changing

or Moving an Account to Another Folder section for instructions on

how to move to another folder at the same time the G/L Account entry is

changed.

General Tab

Go to the General Ledger > Account

> General tab, and the following window will appear:

- The Type setting cannot

be changed after an account is created. The possible types are Asset,

Liability, Capital, Revenue, or Expense.

- Inactive is a check box

for accounts that are no longer being used. If an account is inactive,

a warning message will be displayed each time the account code is

entered. For more information, review the section on Making

an Account Inactive.

- The Description should

be the name of the account. For example: Checking Account, Retail

Sales, or Advertising. The description can be changed without any

adverse effects on the system.

- The Department field describes

the department identified in this account. If the department code

is zero (?????-000), this entry can be used to further describe the

account. See the Departments

and Profit Centers section for more details.

- Use the Note to record

any information about this account. This entry is used only for miscellaneous

information and is not printed on most general ledger financial reports.

- Reconcile This Account

is a check box to enable the accounting system to include accounts

in the reconciliation function. Checking this box will highlight the

Reconcile button and add some

additional entry fields in the advanced tab. For more information,

review the section on Account

Reconciliation.

- The Bank Account button

will be active only on accounts that are classified as bank accounts.

See the section on Account classification for more on how to classify

accounts as bank accounts.

- Click Budget to display

budget totals for account. See section on Budgets

for more information.

- The Profit Centers button

will be active if the Use Profit

Center switch is enabled in the

tab. Review the section on Departments

and Profit Centers for more information on using Profit Centers.

- The New button brings up

the wizard to add a new General Ledger account. Review the Adding

General Ledger Accounts section for further instructions.

Review [Main]

Reports > Print Button for details on setting up reports in this

window and using the Print option.

Advanced Tab

Go to the tab, and the following

window will appear:

- If the current account is a Revenue or Expense type, the Retained

Earnings Account entry must be set; otherwise this entry field is

disabled and can be ignored. If this entry field is enabled, it must

contain a general ledger account that is classified as a retained

earnings account. All the available accounts can be listed by clicking

on the down arrow to the right of this entry field. Review the Account Classification section

for more information on the use of Retained Earnings accounts. Since

our example above is an expense type account, we set the retained

earnings to reflect the account entered in the Equity folder.

- The 1099 Form setting is

important when printing year-end 1099 forms. Review the Printing

1099 Forms section for more details on this setting.

- The Printed Register Balance

entry only shown when the Reconcile

this Account box in the General

tab is checked. All accounts classified as a Bank Account should be

reconciled, as well as Cash accounts and accrued tax accounts. The

Printed Register Balance reflects

the ending balance of the last printed register. For example, in the

account shown below, this field would allow the user to record the

ending balance of the previous check register in order to use it as

the beginning balance of the next report.

- The Last Reconcile information

is updated with user login name, date and time when the Account Reconciliation

Process is completed. Review the Account

Reconciliation section for more details.

OK will save changes and return

to the main window.

Cancel will not save changes

before returning to the main window.

New will bring up the window

to start entering a new G/L account. Review the Adding

General Ledger Accounts section for details on the new wizard.

Delete will delete the selected

G/L account. Note that a G/L account cannot be deleted if transactions

exist in any year tabs. Instead of deleting a G/L account, they should

either be merged with another account or moved to an inactive status.

For further information on merging an account or making a G/L account

inactive, review the Making an

Account Inactive section.

Print has a drop-down list of

reports linked to this window. A report can be added by selecting Add a Report at This Time.