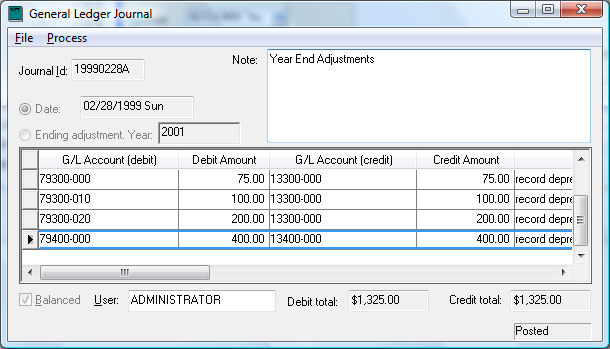

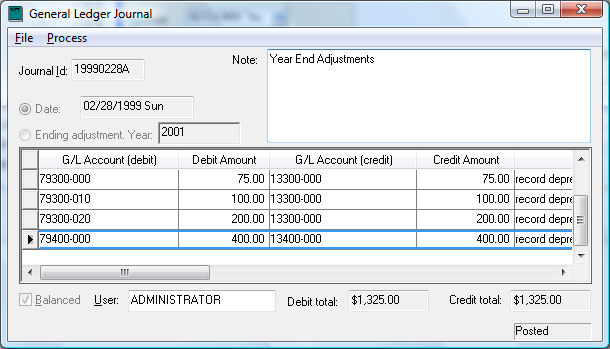

If year-end adjusting entries need to be made, they can be made several

different ways. They can be posted to the last month of the year, or the

last month can be closed and the entries can be posted to the 13th month

that EBMS allows in a year. Using the 13th month will help to keep the

last month of the year from looking extremely different in the case of

large year-end adjustments. To post a journal entry to the 13th month,

follow the steps in making general journal entries but make certain to

check the switch in front of Ending Adjustment Year and select the correct

year.

Year-end adjustments can consist of many things including depreciation, loan balance adjustments, etc. The year-end adjustments that need to be made will depend on how many adjustments are made on a regular monthly basis and how many are left until the year end. They can also depend on the type of taxpayer. Some adjustments need to be made for tax purposes. If using outside tax advisors or financial statement preparers, they will give you year-end adjustments to make sure you have proper beginning balances for the New Year.