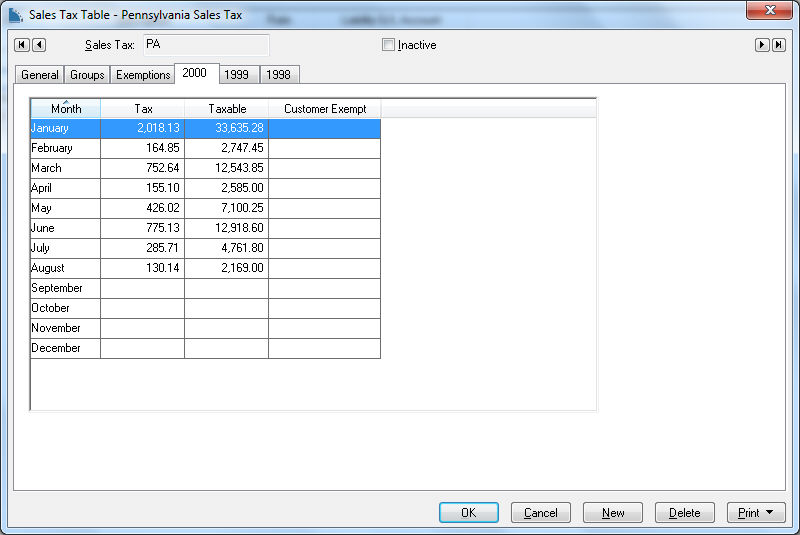

The details sales tax transaction history can be reviewed by selecting a sales tax from the Sales > Sales Tax > Rates menu. These totals include both sales and use tax totals.

Open a Sales Tax Rate by double clicking on a Tax Table.

Click on a history year tab.

The Tax column identifies the total amount of tax collected for each period and the Taxable amount identifies the total that was taxable. The Customer Exempt column shows the total amount of sales that were sold to customers that were sales tax exempt. This column does not include items that are non-taxable. Use sales tax reports found in to review tax details.

An alternative method to report and file sales tax is the TaxJar sales tax subscription. Review TaxJar > Overview for details.