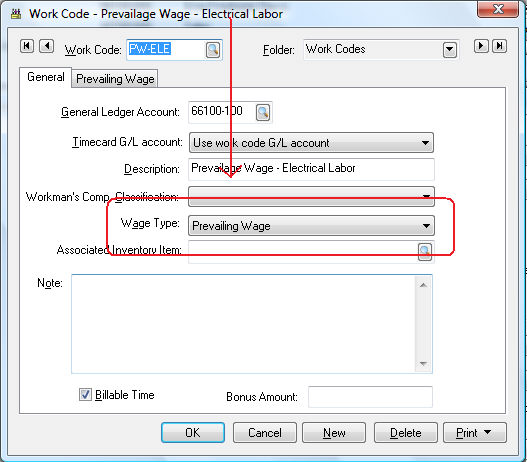

Prevailing wages are normally set based on the type of work that is performed on the job. The variable rates are set in EBMS using the work code and job.

Click on Labor

> Work Codes to set the rate for each work code. Create a separate work code for each type of task that contains a different prevailing wage rate. Review the Prevailing Wages > Creating Work Codes for Prevailing Wage Rates section for more detail on creating work codes for prevailing wages.

A Prevailing Wage tab will appear if the Wage Type is set to Prevailing Wage as shown above. Click on the Prevailing Wage tab.

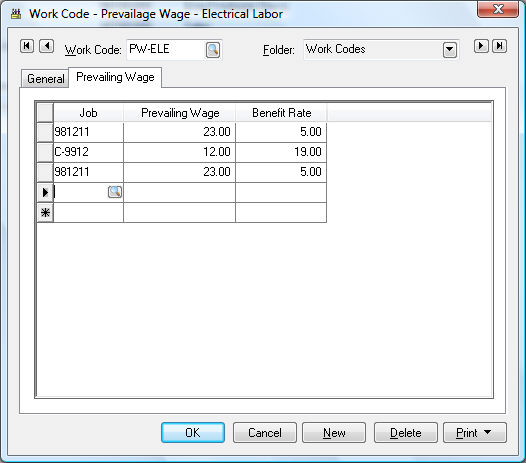

The following job list will appear on the tab if the optional Job Costing module is installed within EBMS. Otherwise the

Prevailing Wage tab will only show a single set of rates. The Job Costing module must be installed to set prevailing wages based on the job. Contact an EBMS worker service rep for more details on the job costing module.

The Prevailing Wage tab will show a table of job entries if the Job costing module exists. The prevailing wage rate consists of two rates; Prevailing Wage and the Benefit Rate.

The employee is paid a minimum of the

Prevailing Wage rate and a maximum based on the

Prevailing Wage rate plus the

Benefit Rate. For example based on the example shown below, the employee will be paid a minimum of $23 an hour for job - 981211 or a maximum of $28 an hour based on the

Prevailing Wage Benefit set within the employee. Click on the

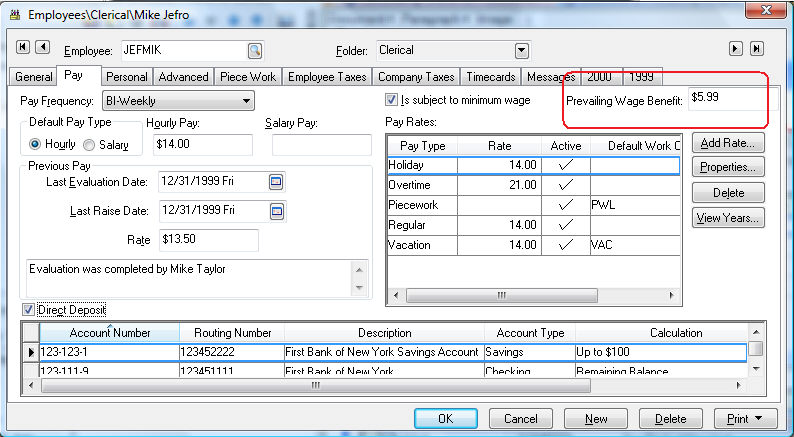

Pay tab of an employee to set the

Prevailing Wage Benefit rate as shown below:

The Prevailing Wage Benefit rate should reflect the total hourly value of the benefits given to an employee such as holiday pay, vacation pay, medical insurance, and any other company paid benefit. This hourly rate will be used to calculate the prevailing wage within the timecard. The employee’s pay = the Prevailing Wage rate within the work code tab + (the Benefit Rate within the work code – Prevailing Wage Benefit rate set within the employee). If the Prevailing Wage Benefit rate within the employee record is greater than the Benefit Rate within the work code the total pay will be equal the Prevailing Wage amount found in the work code.

Using the examples shown above, Mike Jeffro (JEFMIK) will be paid a prevailing wage of $5.99 an hour for electrical labor (PW-ELE work code) for the 981211 job.

Note: The formula set for hourly pay must be set to use the hourly pay setting within the pay tab for prevailing wages to be calculated properly. For example, the Regular pay type formula must be set to Equal to rather than set to a specific rate. Review the Workers > Setting Employee Defaults section for more details on setting pay rates.

Overtime pay rates are calculated based on the average pay on the timecard rather than calculated from the hourly pay rate entered in the Pay tab of the employee record. Review the Processing Payroll > Calculating Overtime section for more details.

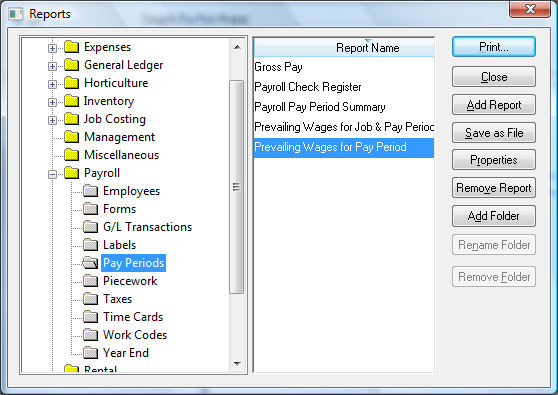

Go to the

option from the main EBMS menu to view the prevailing wage reports.

Prevailing wage reports can be found within the Labor > Pay Periods section of the reports menu as shown above. Prevailing wage reports are useful to communicate certified payroll job summary to the state.