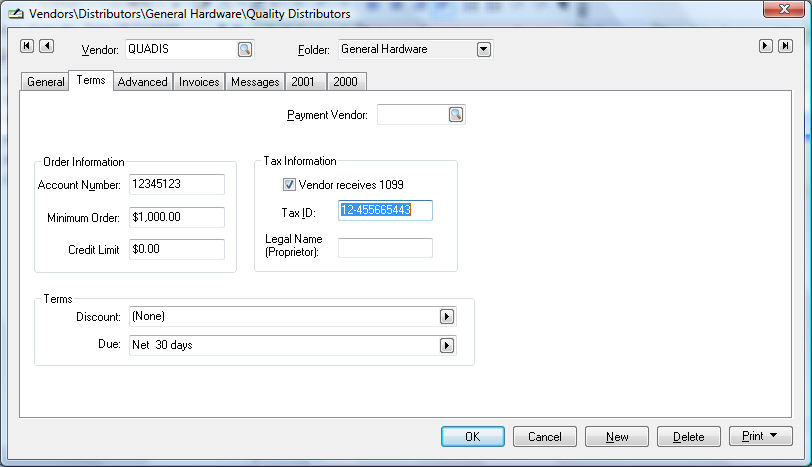

Go to to set the 1099 vendor options.

Enable the Vendor

receives 1099 option if this vendor is eligible to receive

a 1099.

Contact an accountant or an EBMS consultant for criteria that determine

if the vendor is eligible. A vendor does not always receive a 1099

form when the Vendor receives 1099

is enabled since the payments made to the vendor must equal

or exceed threshold amounts for specific General Ledger accounts.

Enter the vendor supplied Tax Identification number for every vendor that is selected to receive a 1099.